Aircraft depreciation calculator

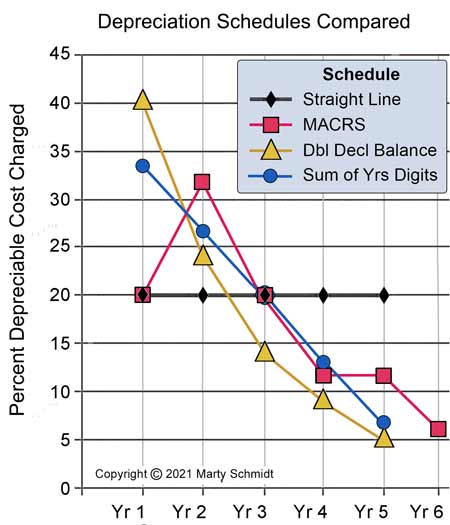

Aircraft depreciation calculator Minggu 18 September 2022 Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear. Year 2 - 32.

Calculator Damaged Luggage On The Flight

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

. Depreciation for the engine and. 80 for aircraft placed in service in 2023. Depreciation per year Asset Cost - Salvage.

Supports Qualified property vehicle maximums 100 bonus safe harbor rules. Its free to sign up and bid on jobs. We also explain Section 179.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease. Web-Based Platform Pre-loaded data fully editable by. Free MACRS depreciation calculator with schedules.

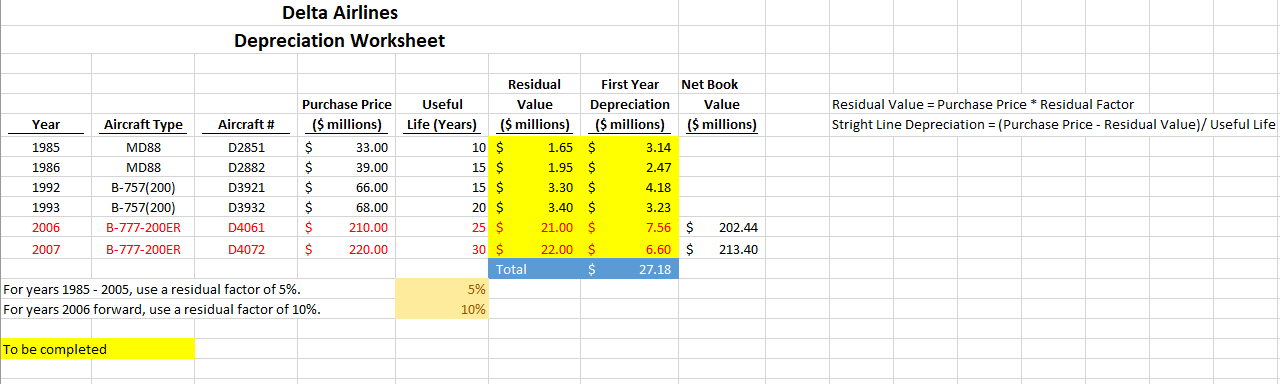

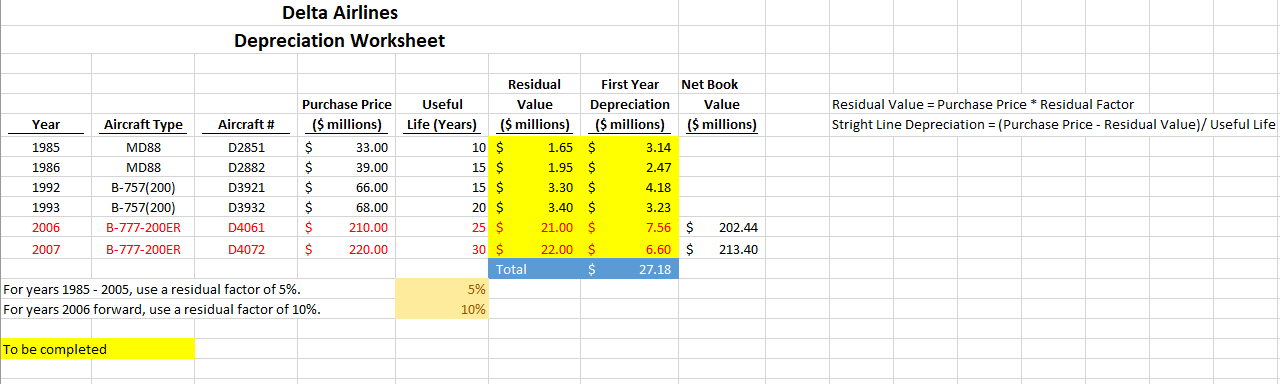

2 The determination of the appropriate depreciation life five-year or seven-year is based on the primary use of the aircraft4 In the case of leased aircraft that determination is made based. Search for jobs related to Aircraft depreciation calculator or hire on the worlds largest freelancing marketplace with 21m jobs. With this tool you will get a better idea of what it costs per hour to fly your airplane wet and dry.

An aircraft loan calculator that allows one to enter data for a new or existing aircraft loan to determine ones payment. Welcome to the Hourly Rate Calculator. Year 1 - 20.

For that reason its important to distinguish IRS airplane depreciation for the IRS from GAAP Generally Accepted Accounting Principles airplane depreciation. Its a front-loaded system that lets you deduct most of the cost of your aircraft within a few years. 30 special allowance unless it is certain property with a long.

The taxpayer is allowed to deduct only 65 of the other aircraft. With these numbers you can determine an. 60 for aircraft placed in service in 2024.

Boeing 737-700 DEPRECIATION CALCULATOR The schedule above reflects commonly used aircraft tax depreciation rates. When calculating airplane depreciation the mechanical structure or the frame of the airplane is based on an estimated useful life of 25 years. After that the percentage of first-year bonus depreciation will decrease according to the following schedule.

The effective rate of bonus depreciation in year 1 for this taxpayer is not 100 due to personal entertainment passengers. Adheres to IRS Pub. The Senate Finance Committee recently voted to extend bonus depreciation and other tax incentives known as tax extenders by two years through Dec.

The total number of units that the asset can produce. These may or may not be applicable to your individual situation. Aircraft Cost Calculator enables users to determine the true operating costs of the hundreds of aircraft and helicopters in our database.

One can enter an extra payment and a rate of depreciation as well to. Heres an example MACRS schedule with percentage deductions. 31 2016 and NBAA.

With this method the depreciation is expressed by the total number of units produced vs.

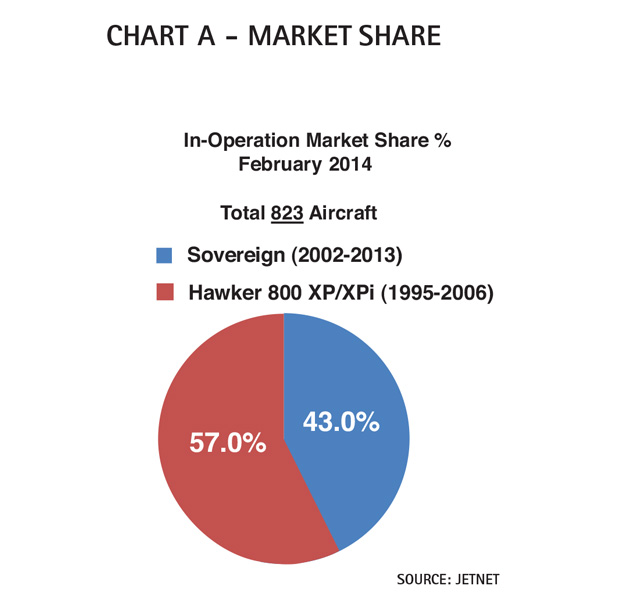

Jet Comparison Cessna Citation Sovereign Avbuyer

Jet Comparison Cessna Citation Sovereign Avbuyer

Should You Rent Or Buy Your Aircraft Flying Magazine

Depreciation Turns Capital Expenditures Into Expenses Over Time

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Macrs Depreciation Calculator Irs Publication 946

Jet Comparison Cessna Citation Sovereign Avbuyer

What Is The Importance Of Maintenance For The Airlines Industry Aircraft Maintenance Asset Management Maintenance

Borrowing The Company Jet Business Jet Traveler

Private Jet Price How Much Does A Private Jet Cost

Depreciation Turns Capital Expenditures Into Expenses Over Time

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Solved In This Model We Used Fresh Start Accounting If Chegg Com

New Functionality In Maximo 7 6 0 3 Asset Depreciation Schedules Projetech Inc

New Functionality In Maximo 7 6 0 3 Asset Depreciation Schedules Projetech Inc